Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first chapter of each course. Start Free

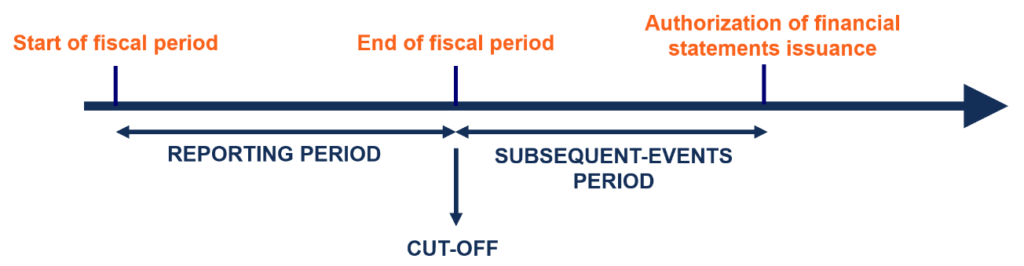

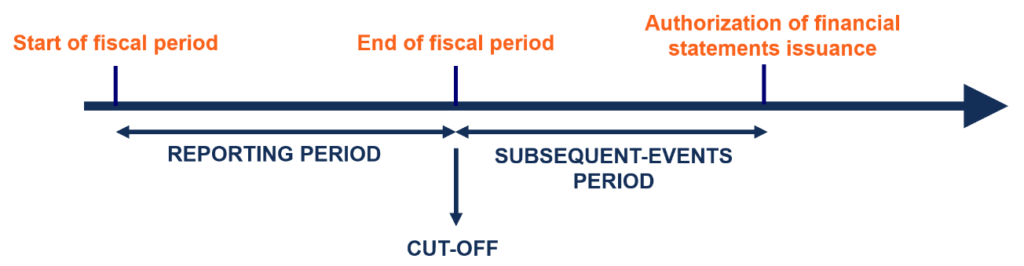

Subsequent events are events that occur after a company’s year-end period but before the release of the financial statements. In other words, subsequent events are events that happen between the cut-off date and the date in which the company issues its financial statements. Depending on the situation, subsequent events may require disclosure in a company’s financial statements.

The typical reporting period for a company is 12 months. However, a reporting period does not need to match the calendar year from January 1 to December 31. Typically, companies will choose a year-end corresponding to a period of low activity. For example, retailers usually follow a year-end at the end of January when inventory is low (post-holiday season).

The cut-off date refers to the end of the reporting period and the start of the new reporting period. It is important in accrual accounting because cash cycles may not be complete. Therefore, it is necessary to understand which events will be during the current reporting period and which events will be recorded in the next reporting period. Transactions and events are recognized up to the cut-off date.

Between the period of the cut-off date and the authorization of financial statements issuance is the subsequent events period. Depending on the type of subsequent event, it may or may not require an adjustment to the financial statements. Transactions and events that change the measurement of transactions before the cut-off date are recognized.

After the cut-off period (after the company’s year-end) and before the issuance of financial statements, Company A’s major client unexpectedly goes bankrupt. It is determined that the company will only get 10% of its outstanding accounts receivable from the major client. The event will require an adjustment to the financial statements of Company A.

There are two types of subsequent events:

An event that provides additional information about pre-existing conditions that existed on the balance sheet date.

A subsequent event that provides new information about a condition that did not exist on the balance sheet date.

For subsequent events that provide additional information about pre-existing conditions that existed on the balance sheet date, the financial statements are adjusted to reflect this additional information.

For subsequent events that are new events and thus do not provide additional information about pre-existing conditions that existed on the balance sheet, these events are not recognized in the financial statements. However, a subsequent event footnote disclosure should be made so that investors know the event occurred.

CFI offers the Financial Modeling & Valuation Analyst (FMVA)® certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following CFI resources will be helpful:

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.